Ad

related to: Saving for the DayLearn how to budget, save, and manage your personal finances for free with Money Canvas™. Free one-on-one sessions with a money coach to help you improve your financial habits.

Search results

- 2023 · Romance · 1h 45m

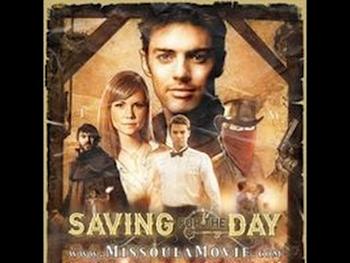

Mar 11, 2023 · Saving for the Day: Directed by John D. Nilles. With Andy Shirtliff, Lindsey Zachariasen, James McGahee, Cheyenne Adamson. An introvert is given a locked treasure chest worth millions which forces him to go on a wacky series of multi-genre adventures to find the key.

- (18)

- Action, Adventure, Comedy

- John D. Nilles

- 2023-03-11

Penny-pinching hermit Joe Bell is saving for the day when his real life will begin. One day, he's given a locked chest full of treasure by a cryptic old man. Joe must go on a series of...

- Action, Western, Adventure, Comedy, Drama, Fantasy, Horror, Romance, Sci-Fi, War

- Lindsey Zachariasen

- John D. Nilles

Oct 17, 2020 · SAVING FOR THE DAY Official Trailer (2023) Joe Bell is a penny-pinching hermit saving for the day when his real life will begin. One day he’s given a chest filled with treasure by a...

- 2 min

- 1815

- Shoot Montana

- Daily Savings

- Monthly Savings

- Annual Savings

- The Bottom Line

1. Brown Bag It

A sandwich at a deli near work can cost $5 to $10 a day. That might not seem like much. But over a year, spending that every work day puts your annual expenditure into four figures. If you instead bring food from home, you can feed yourself for half as much. If you invest those savings—an average of $35 a week, or about $1,820 a year, you’d have saved $94,749after 25 years.

2. Brew Your Own

A cup of decent coffee at a premium shop can easily run from $2.50 to $4 or more, and that usually won't buy you a latte or other specialty drinks. Buy just a single cup every day and you’ll be spending between $625 to $1,000 a year—in after-tax money. Then consider that a pound of good coffee at the same store costs about $15 and brews at least 30 cups of coffee. If you brew one cup a day at home, instead of buying one at the store, you'd spend about $125 a year. Total savings: $500 to $875...

3. Join Supermarket Loyalty Programs

Signing up as a loyal customer at a major food chain can allow you access to member-only specials and sometimes to manufacturers' coupons, too. Whole Foods offers an especially rich program for those who are members of Amazon Prime, its parent company's premium membership (which costs $139 a year but delivers other perks, too). Prime members qualify for deep discounts on dozens of sale items at Whole Foods stores every week. (Recent examples for New York City: Boneless skinless chicken breast...

6. Charge It to a Cash-Back Card

Maximize your credit card benefits by putting as many regular expenses as you can on a credit card that offers generous cash-back rewards: Groceries, gas, utilities, restaurants, everything you can think of. Make sure, though, that you pay off your credit card bill in full at the end of the month. Paying interest on a balance will wipe out any rewards you’d have earned, and probably more. A family could easily charge $2,000 a month on a rewards card. The Capital One Quicksilver Rewards Card,...

7. Shop for Home Telecom Service

Most areas have more than one company that provides cable TV, Internet, and landline services. Sometimes there’s a big price difference between them. Don’t be shy about switching, or calling your current provider and threatening to leave—a move that may yield some offers you won't find on the website. You could also drop your landline, for modest savings, or your TV service. Cutting cable or satellite TV is more ripe for significant savings, especially with the arrival of web-based cable subs...

8. Consider Switching Mobile Services

If you're no longer under a contract with your carrier—and you're not paying off your phone—you might be able to switch to a less expensive networkwithout having to buy a new phone. For example, AT&T, T-Mobile, and Verizon phones can generally be used interchangeably. Verify compatibility for your specific phone with the carrier or by using checkers such as this onefrom Whistleout.com. You should also consider coverage in your area and compare extra features such as free video services and da...

11. Reduce Your Insurance Premiums

Review your homeowner’s and auto insurance policies at least every year for changes that could save you money. Even if you don't opt for an entirely new carrier, a host of moves can help you reduce premiums.For example, consolidating all the policies you hold with one company typically earns a discount of between 5% and 25% on each. If you're insuring an older car, its optional collision and comprehensive coverage may no longer make financial sense if the maximum claim payout (the vehicle's v...

12. Use Apps to Help Track and Save Money

A rise in both the number and the quality of personal finance apps has made it far easier to know from your smartphone or computer where your money is going, and to help you save more painlessly. Take one of Investopedia's top personal finance apps, which is free. All-in-one resource Mint will help you create a budget, track your spending, connect all your bank and credit card accounts, and remind you of all your monthly bills.

13. Enroll in Your Employer’s Retirement Savings Program

The closest thing to free savings is the matching contributions many employers offer for company-sponsored 401(k), SIMPLE IRA, and other salary deferral feature plans. Employers who offer the perk typically add up to half of your contribution to the plan. If you're hesitating to join the company plan, then, you're losing out on not only the benefit of tax-deferred retirement savings of your own but on having those contributions supercharged by your employer. An example illustrates just how mu...

Chances are slim that you'll want—or be able—to take advantage of all of these savings strategies, and your gains from them will surely vary if you do. Still, it's inspiring and impressive to total the take from all the strategies we outlined. Collectively, they'd deliver a nest egg after 25 years of about $524,000. And they'd do so, for the most p...

- 9 min

- Automate transfers. By setting up automatic transfers from your checking account to your savings account each month, the money will accumulate over time without any additional work on your part.

- Count your coins and bills. Another option is saving your change manually by setting it aside each night. After you have a sizable amount, you can deposit it directly into your savings and watch your account grow from there.

- Prep for grocery shopping. A little work before you go to the grocery store can go a long way toward helping you save money on groceries. Check your pantry and make a shopping list to avoid impulse buying something you don't need.

- Minimize restaurant spending. One of the easiest expenses to cut when you want to save more is restaurant meals, since eating out tends to be pricier than cooking at home.

Mar 11, 2023 · Is Saving for the Day (2023) streaming on Netflix, Disney+, Hulu, Amazon Prime Video, HBO Max, Peacock, or 50+ other streaming services? Find out where you can buy, rent, or subscribe to a streaming service to watch it live or on-demand. Find the cheapest option or how to watch with a free trial.

People also ask

Who are the actors in saving for the day?

How do you save money before you really need it?

Is saving money worth it?

How much money can you save a year?

Saving For The Day is a multi-genre adventure film. There are over a dozen genres in this unique passion project. Joe Bell is a penny-pinching hermit saving for the day when his real life will begin. One day he’s given a chest filled with treasure by a cryptic, old man.