Search results

- The Wall Street Journal

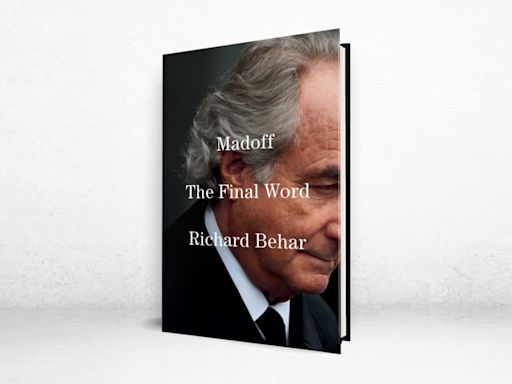

‘Madoff: The Final Word’ Review: Ponzi’s Heir

Madoff’s estate was seized and sold off. The fallout has gone beyond financial misery. Some investors who lost money killed themselves, as did Madoff’s son Mark on the two-year anniversary of ...

17 hours ago

- Forbes

The Sins Of Ruth Madoff

Madoff Investment Securities (BLMIS) from 1961 to 1963, but then left to raise their sons. As with every Ponzi scheme, Bernie Madoff lured in new money by pointing to the mammoth gains being ...

3 days ago

Critics say opacity caused the Madoff crisis. When Bernard Madoff started his investment company, Bernard L. Madoff Investment Securities, LLC, he conducted business honestly. Around the early 1990s, he stopped trading and started fabricating returns. He issued false statements.

May 10, 2023 · Financial statements sent to clients were entirely fabricated but made to look credible by being in line with actual events in the stock exchange over corresponding time periods (Van de Bunt, 2010).

Jun 23, 2024 · Bernie Madoff was an American financier who orchestrated the largest Ponzi scheme in history, collecting about $65 billion that he had no intention of investing.

Jul 17, 2017 · Notorious financier Bernie Madoff bilked more than 10,000 investors out of billions of dollars in the 1990s and 2000s in the largest financial fraud in U.S. history. But the effect of Madoff’s elaborate Ponzi scheme rippled far beyond his direct victims.

In December of that year, Bernie Madoff, the former Nasdaq chairman and founder of the Wall Street firm Bernard L. Madoff Investment Securities LLC, admitted that the wealth management arm of his business was an elaborate multi-billion-dollar Ponzi scheme.

A Critical Analysis of Bernie Madoff’s “Historic” Securities Fraud. Before being arrested, Madoff invested more than $37 billion, but his auditing firm was a three-person accounting firm in a small New York storefront.

Apr 14, 2021 · 1. Madoff’s victims are close to getting their money back. Irving Picard, the court-appointed trustee in the Madoff case, has recovered more than $14.4 billion of the $20 billion in stolen ...