Search results

The IRS provides information and services for taxpayers, businesses, and tax professionals. You can file your taxes online, check your refund status, get tax forms, and more.

- Your Online Account

Access your individual account information including...

- Forms & Instructions

Application for IRS Individual Taxpayer Identification...

- Refunds

Explore options for getting your federal tax refund, how to...

- Contact Your Local Office

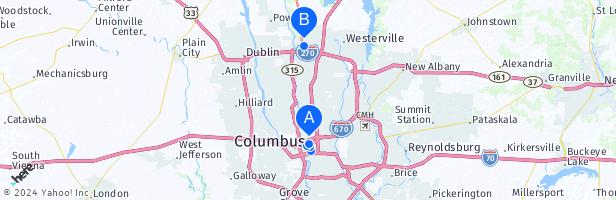

You can get in-person help at your local IRS Taxpayer...

- Tax Professionals

Information for tax professionals. Access online tools for...

- Businesses

Find tax information and tools for businesses including...

- Individuals

File with an IRS Free File partner. IRS Direct File is...

- Where's My Amended Return

IRS phone numbers and tax help options. Related. Amended...

- 2021 Child Tax Credit

Under the American Rescue Plan of 2021, advance payments of...

- Sign in to your account

- IRS Free File Prepare and file your federal income taxes online for free. Try IRS Free File

- Where's My Refund Get your refund status

- Bank Account (Direct Pay)

- Get Your Tax Record

- Get an Identity Protection PIN (IP PIN)

- Tax Withholding Estimator

- Free tax preparation Get free one-on-one tax preparation help nationwide if you qualify Find a site near you

- Employee Retention Credit You can withdraw incorrect ERC claims if you haven’t received the money

- Inflation Reduction Act Strategic Operating Plan See how the IRS will deliver transformational change Read the Plan

- Clean energy credits and deductions Updates on credits and deductions under the Inflation Reduction Act

- Tax Updates and News Special updates and news for 2024 Read the latest developments

- Penalty relief for many taxpayers Prior year collection notices to resume in 2024

- Your Online Account

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law.

Enter your Social Security Number, Tax Year, Filing Status, and Refund Amount to get your refund status. This system is secure and monitored by the IRS for your protection.

Find answers to your tax law questions, access your online account, make payments, and more. Browse the tools for individual taxpayers, businesses, and tax professionals on the official IRS website.

IRS Free File: Guided Tax Software. Do your taxes online for free with an IRS Free File trusted partner. If your adjusted gross income (AGI) was $79,000 or less, review each trusted partner’s offer to make sure you qualify. Some offers include a free state tax return.

Learn how to file your federal income tax return online for free with IRS Free File partners or Free File Fillable Forms. Find out if you qualify, what you need to get started, and your protections and security.