Search results

People also ask

How do I contact Tulare County about my property taxes?

What does a Tulare County tax collector do?

Where can I find property records in Tulare County?

How do I send documents to the Tulare County assessor's office?

Treasurer - Tax Collector: 559-636-5250 221 South Mooney Blvd. Room 104 E Visalia, CA 93291. Property Tax Bill by Phone, Call (877) 736-9055. Email: Taxhelp@tularecounty.ca.gov Fraud Hotline

- Payments

Payments - Home - Treasurer-Tax Collector - Tulare County,...

- Tax Collector

To pay your property tax by phone, call 1-877-736-9055. If...

- My Taxes

Treasurer - Tax Collector: 559-636-5250 221 South Mooney...

- Mobile Home Tax Clearance

Mobile Home Tax Clearance - Home - Treasurer-Tax Collector -...

- Publications

Publications - Home - Treasurer-Tax Collector - Tulare...

- Property Tax Accounting

Property Tax: 559-636-5250 221 South Mooney Blvd. Room 101 E...

- Forms

Forms - Home - Treasurer-Tax Collector - Tulare County,...

- Unclaimed Monies

Unclaimed Monies - Home - Treasurer-Tax Collector - Tulare...

- Contact Us

County Civic Center 221 South Mooney Boulevard Rm 104E...

- Auditor Divisions

Auditor Divisions - Home - Treasurer-Tax Collector - Tulare...

- Payments

- Accounting

- Cashiers

- Secured Property Current Year Tax Information

- Prior Year Secured Delinquent Tax Redemption

- Prior Year Secured Tax Defaulted Property

- Unsecured Property Tax Administration and Information

- Unsecured Property Tax Collection Enforcement

- Payment Information

- Mandated Services

The main functions of the Accounting Section are to see to it that the payments are applied to the individual accounts correctly and promptly and to report the collections and appointment to the Auditor's Office for distribution to the schools, cities and special districts. This unit provides the following cashiering services.

The cashier's section takes the deposit from the offices within the County and payment of taxes from tax payers. These collections are deposited to the bank for investments and payment of disbursements made by the offices in the County. The bulk of the payments are received in August for Unsecured Taxes and December and April for Secured Taxes. The...

The primary responsibilities of the secured property current year unit are the preparation and distribution of current year regular and supplemental tax bills and corrected tax bills, provide tax information and assistance, process payments and payment notices. The unit provides the following current year secured property tax services: 1. Process c...

Properties for which taxes are unpaid at the close of the fiscal year are declared Tax-Defaulted for that fiscal year. This unit provides the following prior year tax services: 1. Redemption information 2. Subdivision maps 3. Installment plans 4. Senior Citizen Property Tax Postponement 5. Process delinquent tax payment receipts

The Tax Collector may offer Tax-Defaulted property, where the taxes remain unpaid for five years or more, for sale through a public auction. This unit provides the following prior year tax services: 1. Publication of tax defaulted property 2. Auction sales of tax defaulted property 3. Sales of tax defaulted property to public agencies 4. Sealed bid...

The primary responsibilities of the unsecured property tax administration unit are the preparation and distribution of tax bills, providing tax information and assistance, administrate tax liens and process payments, payment notices and collection action. This unit provides the following current year and prior year unsecured property tax services: ...

When delinquent unsecured taxes become subject to collection, this unit provides the following delinquent current year and prior years unsecured tax collection enforcement services: 1. Processing of liens and summary judgments 2. Process seizures 3. Orders of examinations 4. Seizure and sale of unsecured property 5. Bank account levies 6. Discretio...

You can obtain Taxes due and make payments online by clicking on "My Taxes." To pay your property tax by phone, call 1-877-736-9055. If you need additional assistance, you may speak with a tax representative during office hours of 8 a.m. - 5 p.m. by calling (559) 636-5250 or sending an e-mail to taxhelp@tularecounty.ca.gov.

The California Revenue and Taxation Code, Section 2602 and the Charter of Tulare County requires the Tax Collector to collect and process all property taxes and to receive and safe keep county revenues from all other sources. Tulare County Ordinance #6-03-1000 requires that the Tax Collector issue annual business licenses in Tulare county's unincor...

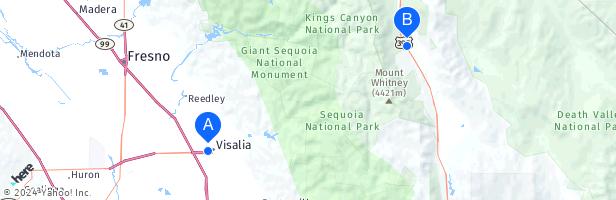

Looking for Tulare County Treasurer-Tax Collector's Office property records? Quickly find Treasurer & Tax Collector phone number, directions & services (Visalia, CA).

Tulare County Tax Collector is located at 221 S Mooney Blvd # 104E in Visalia, California 93291. Tulare County Tax Collector can be contacted via phone at 559-636-5250 for pricing, hours and directions.

- (1)

- (559) 636-5250

- 221 S Mooney Blvd # 104E, Visalia, 93291, CA

Fri 8:00 AM - 5:00 PM. (559) 636-5250. https://tularecounty.ca.gov/county/contact. Tulare County Tax Collector in Visalia, CA is a government agency responsible for collecting property taxes and other tax-related payments from residents and businesses within the county.

- 4235 Redwood Ave, Marina Del Rey, 90066, CA

- (559) 636-5250

Find property records in Tulare County, CA. Access land records, ownership details, public property records, mortgage info, and property maps. Use links to GIS maps, assessment rolls, the assessor's office, building inspections, deed searches, tax records, exemptions, and delinquent tax sales.

You can call the Tulare County Tax Assessor's Office for assistance at 559-636-5100. Remember to have your property's Tax ID Number or Parcel Number available when you call! If you have documents to send, you can fax them to the Tulare County assessor's office at 559-737-4468.