Ads

related to: Do Vanguard index funds pay dividends?Active, Transparent, Tax-Efficient, Time-Tested Core Holdings. Learn About Our ETFs. Investors Deserve More From the Core of Their Portfolios. Learn More About Our ETF Funds.

At Vanguard We Value You & Your Concerns About Your Financial Future. Our Advisors Are Here To Help You Make Informed Decisions About Your Financial Future.

Search results

News about index fund, diversification, growth opportunities

News about dividend, Vanguard, UBS Group AG

Also in the news

Quarterly or annually

- As an investor in Vanguard funds, you become a shareholder and are eligible to receive dividends. Dividends can be in the form of cash or additional shares of the fund, known as dividend reinvestment. Cash dividends are typically paid out quarterly or annually, providing investors with a steady income stream.

livewell.com › finance › how-often-does-vanguard-pay-dividends

People also ask

Does Vanguard pay dividends?

Does the Vanguard S&P 500 ETF pay a dividend?

Is Vanguard a good dividend ETF?

Which stocks are included in the vanguard dividend appreciation ETF?

Apr 9, 2024 · A number of well-regarded Vanguard index funds pay dividends, including the Vanguard High Dividend Yield ETF, the Vanguard Dividend Appreciation ETF, and the Vanguard Real Estate...

- Overview

- Understanding Vanguard ETF Dividends

- What Is an Expense Ratio?

- Is a Mutual Fund Better or an Exchange-Traded Fund (ET?

- How Do Fund Dividends Work?

- Which ETF Pays the Highest Dividend?

- The Bottom Line

Many Vanguard exchange-traded funds (ETFs) pay

on a regular basis, typically monthly or quarterly. Vanguard ETFs specialize in one specific area within stocks or the fixed-income realm.

The investments in stocks or bonds that the funds make typically pay dividends or interest, which Vanguard distributes back to its shareholders in the form of dividends to meet its investment company tax status.

Vanguard offers many different ETFs that specialize in specific sector stocks, stocks of a certain market capitalization, foreign stocks, and government and

of different durations and levels of risk. The majority of Vanguard ETFs are rated three or four stars by Morningstar, Inc., with some funds having two or five stars.

Vanguard is a large investment advisor offering mutual funds and ETFs, many of which pay dividends.

One of the more unique features of Vanguard funds, in general, is they are known in the fund industry for

that are lower than average. As of Jan. 2024, Vanguard ETFs' expense ratios range between 0.03% and 0.22%, while the average expense ratio as of Dec. 2021 (latest information) is about 0.06% for a typical Vanguard ETF, compared to an industry average of 0.24%.

The most expensive Vanguard ETFs tend to be those that invest overseas or have high turnover ratios and specialize in very narrow market niches. The least expensive Vanguard ETFs tend to be those that specialize in corporate or Treasury bonds.

Many investment advisors offer funds with 0% expense ratios.

ETFs are typically judged on their dividend distributions based on a 30-day

, which is a standardized yield developed by the Securities and Exchange Commission (SEC) for the fair comparison of funds. The 30-day SEC yield is calculated based on the last 30-day period and reflects investment income earned by a fund after deducting its expenses.

An expense ratio is a percentage that an investment advisor charges investors for administrative and operating expenses. Expense ratios reduce investors' returns, so it's always a good idea to look for funds with low expense ratios. Generally, passively managed funds will have lower expense ratios than actively managed funds.

Whether a mutual fund or an exchange-traded fund (ETF) is better will depend on the investor and their goals. ETFs have significantly gained in popularity due to the ease of buying and selling them like stocks through online brokerage accounts. Many of them also come with low expense ratios.

Investors in mutual funds or ETFs do not actually own the shares of the companies that the funds invest in; they only own a portion of the fund. However, any shares that pay dividends, those dividends are then passed onto the investor of the mutual fund or ETF directly into their account.

According to VettaFi, the Simplify Tail Risk Strategy ETF pays the highest dividend. It has a dividend yield of 234.58%. The next highest is YieldMax TSLA Option Income Strategy ETF, which pays out a dividend yield of 94.44%; much smaller in comparison to the Simplify ETF. Other managers who offer high-yielding dividend funds include GraniteShares,...

Vanguard is a large investment advisor offering a variety of investment funds. Many of these have low expense ratios, providing affordable investment options for investors. Of the stocks in the funds that pay dividends, Vanguard pays out those dividends to holders of the funds. Investors can use dividend-yielding funds to complement their portfolios in order to generate an income stream, which is particularly beneficial for

investors or those nearing or in retirement.

May 1, 2024 · Vanguard creates index funds by buying securities that represent companies across an entire stock index, or that are targeted to specific groups (for example, an industry sector, similarly...

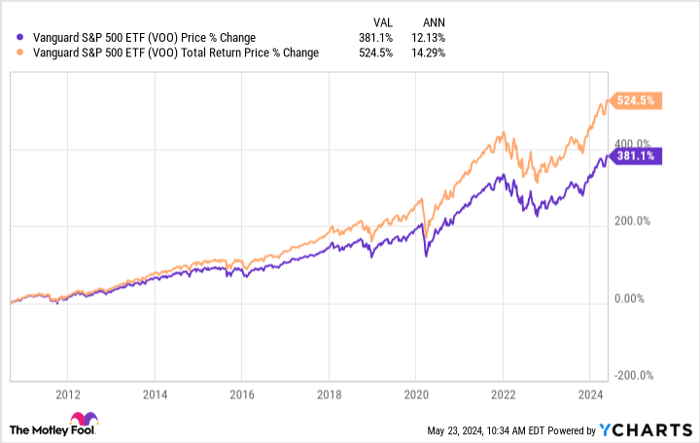

May 2, 2024 · And one of the world’s most popular index funds, the Vanguard S&P 500 ETF (VOO), happens to pay a dividend. However, some income-focused investors may prefer to focus on other funds that...

May 18, 2022 · Yes, the vast majority of index funds pay dividends. The only way an index fund will not pay a dividend is if it is indexed against a selection of stocks that do not pay a dividend. This may be the case if you choose a fund heavy in growth stocks that have yet to achieve profitability.

Ad

related to: Do Vanguard index funds pay dividends?Active, Transparent, Tax-Efficient, Time-Tested Core Holdings. Learn About Our ETFs. Investors Deserve More From the Core of Their Portfolios. Learn More About Our ETF Funds.