Search results

People also ask

Is the margin based on a true story?

What is a margin in a business?

What if you think at the margin?

What does margin mean in a sentence?

What is margin trading?

What does margin mean on a mortgage?

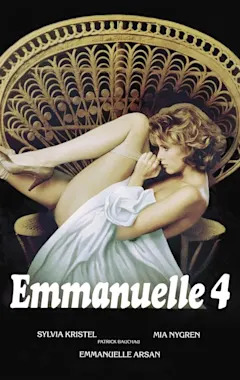

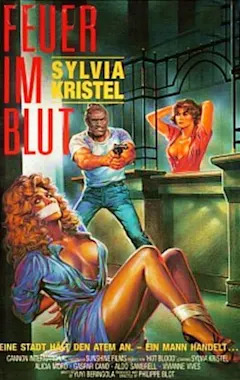

The Margin (French: La Marge, also known as The Streetwalker and Emmanuelle 77) is a 1976 French erotic drama film written and directed by Walerian Borowczyk and starring Sylvia Kristel, Joe Dallesandro, André Falcon, Mireille Audibert and Denis Canuel.

Sigimond Pons (Joe Dallesandro) is a successful businessman who enjoys a peaceful existence in the country with his wife and child. During a business trip to Paris, he...

- Drama

- Sylvia Kristel

- Walerian Borowczyk

Jun 5, 2012 · The meaning of MARGIN is the part of a page or sheet outside the main body of printed or written matter. How to use margin in a sentence.

- What Is Margin?

- Understanding Margin and Marging Trading

- How The Process Works

- Components of Margin Trading

- Special Considerations

- Advantages and Disadvantages of Margin Trading

- Example of Margin

- Other Uses of Margin

- The Bottom Line

In finance, the margin is the collateral that an investor has to deposit with their broker or exchange to cover the credit risk the holder poses for the broker or the exchange. An investor can create credit risk if they borrow cash from the broker to buy financial instruments, borrow financial instruments to sell them short, or enter into a derivat...

Margin refers to the amount of equity an investor has in their brokerage account. "To buy on margin" means to use the money borrowed from a broker to purchase securities. You must have a margin account to do so, rather than a standard brokerage account. A margin account is a brokerage account in which the broker lends the investor money to buy more...

Buying on margin is borrowing money from a broker in order to purchase stock. You can think of it as a loan from your brokerage. Margin trading allows you to buy more stock than you'd be able to normally. To trade on margin, you need a margin account. This is different from a regular cash account, in which you trade using the money in the account. ...

Minimum Margin

By law, your broker is required to obtain your consent to open a margin account. The margin account may be part of your standard account opening agreement or may be a completely separate agreement. An initial investment of at least $2,000 is required for a margin account, though some brokerages require more. This deposit is known as the minimum margin.

Initial Margin

Once the account is opened and operational, you can borrow up to 50% of the purchase price of a stock. This portion of the purchase price that you deposit is known as the initial margin. It's essential to know that you don't have to margin all the way up to 50%. You can borrow less, say 10% or 25%. Be aware that some brokerages require you to deposit more than 50% of the purchase price. You can keep your loan as long as you want, provided you fulfill your obligations such as paying interest o...

Maintenance Margin and Margin Call

There is also a restriction called the maintenance margin, which is the minimum account balance you must maintain before your broker will force you to deposit more funds or sell stock to pay down your loan. When this happens, it's known as a margin call. A margin call is effectively a demand from your brokerage for you to add money to your account or close out positions to bring your account back to the required level. If you do not meet the margin call, your brokerage firm can close out any...

Because using margin is a form of borrowing money it comes with costs, and marginable securities in the account are collateral. The primary cost is the interest you have to pay on your loan. The interest charges are applied to your account unless you decide to make payments. Over time, your debt level increases as interest charges accrue against yo...

Advantages

The primary reason investors margin trade is to capitalize on leverage. Margin trading centers increasing purchasing power by increasing the capital available to purchase securities. Instead of buying securities with money you own, investors can buy more securities using their capital as collateral for loans greater than their capital on hand. For this reason, margin trading can amplify profits. Again, with more securities in hand, increases in value have greater consequential outcomes becaus...

Disadvantages

If investors primarily enter into margin trading to amplify gains, they must be aware that margin trading also amplifies losses. Should the value of securities bought on margin rapidly decline in value, an investor may owe not only their initial equity investment but also additional capital to lenders. Margin trading also comes at a cost; brokers often charge interest expense, and these fees are assessed regardless of how well (or poorly) your margin account is performing. Because there are m...

Let's say that you deposit $10,000 in your margin account. Because you put up 50% of the purchase price, this means you have $20,000 worth of buying power. Then, if you buy $5,000 worth of stock, you still have $15,000 in buying power remaining. You have enough cash to cover this transaction and haven't tapped into your margin. You start borrowing ...

Accounting Margin

In business accounting, margin refers to the difference between revenue and expenses, where businesses typically track their gross profit margins, operating margins, and net profit margins. The gross profit margin measures the relationship between a company's revenues and the cost of goods sold(COGS). Operating profit margin takes into account COGS and operating expenses and compares them with revenue, and net profit margin takes all these expenses, taxes, and interest into account.

Margin in Mortgage Lending

Adjustable-rate mortgages (ARM) offer a fixed interest rate for an introductory period of time, and then the rate adjusts. To determine the new rate, the bank adds a margin to an established index. In most cases, the margin stays the same throughout the life of the loan, but the index rate changes. To understand this more clearly, imagine a mortgage with an adjustable rate that has a margin of 4% and is indexed to the Treasury Index. If the Treasury Index is 6%, the interest rate on the mortg...

Investors looking to amplify gain and loss potential on trades may consider trading on margin. Margin trading is the practice of borrowing money, depositing cash to serve as collateral, and entering into trades using borrowed funds. Through the use of debt and leverage, margin may result in higher profits than what could have been invested should t...

- Jason Fernando

- 2 min

The Margin. 1976. La marge. Directed by Walerian Borowczyk. The line between love and lechery. A businessman leaves his country home, and wife and young son for a business trip to Paris. While there he develops a sexual and spiritual bond with a call girl. Cast. Crew. Details. Genres. Releases.

- (795)

- Walerian Borowczyk

The Margin: Directed by Walerian Borowczyk. With Sylvia Kristel, Joe Dallesandro, André Falcon, Mireille Audibert. Sigismond has a relationship with his wife. On a Paris trip, he becomes obsessed with a prostitute resembling his wife.

What does it mean to think at the margin? It means to think about your next step forward. The word “marginal” means “additional.” The first glass of lemonade on a hot day quenches your thirst, but the next glass, maybe not so much. If you think at the margin, you are thinking about what the next or additional action means for you.