Search results

People also ask

What is real estate financing?

What is real estate finance & how does it work?

What financing options are available in real estate?

Should you finance a real estate deal?

May 23, 2024 · Compare the latest rates, loans, payments and fees for ARM and fixed-rate mortgages. View current Columbus, OH mortgage rates from multiple lenders at realtor.com®.

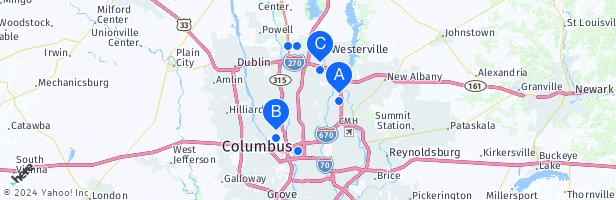

Zillow has 114 homes for sale in Columbus OH matching Owner Financing Available. View listing photos, review sales history, and use our detailed real estate filters to find the perfect place.

Sep 11, 2023 · Learn how a mortgage works, the types of loans available, the interest rates and terms, and the steps to apply for a mortgage. A mortgage is a loan you take out on a piece of land or real estate when you don’t have all the cash-on hand to buy, improve or maintain it.

- It’s common for homeowners to refinance their mortgage at some point during homeownership. The simplest type of refinance is called a rate-and-term...

- Yes, you can pay off your mortgage before you reach the end of your loan term if your mortgage agreement allows. Typically, you do this by making e...

- Yes, you may choose to sell your home even if you still owe money on the mortgage. In fact, according to Zillow research from 2021, the typical hom...

- Benefits

- Terminology

- Funding

- Causes

- Cost

- Definition

- Advantages

- Example

- Types

- Purpose

- Uses

- Scope

- Risks

- GeneratedCaptionsTabForHeroSec

Investing in real estate is never a bad idea. It offers potential investors a slew of financial and personal benefits such as increased cash flow, home appreciation and tax benefits. In fact, real estate investment continues to be one of the most popular vehicles in producing financial wealth. According to the IRS, approximately 71 percent of Ameri...

Real estate financing is a term generally used to describe an investors method of securing funds for an impending deal. As its name suggests, this method will have investors secure capital from an outside source in order to buy and renovate a property. Not unlike traditional financing, however, real estate financing comes complete with terms and un...

As an investor, there are a few different ways to go about financing real estate investments. Each one will have its own set of pros and cons, and your financing approach will depend on the property and the situation. For beginner investors, its important to remember that not all financing options are created equal. What works for someone else may ...

Financing a real estate deal tends to send new investors into a fit of anxiety, or is even enough to compel them to pack up their dreams and retreat back to their nine-to-five job. However, if an investor commits to doing his or her due diligence, the fear of a lack of funds is irrational.

Furthermore, hard money lenders also charge fees apart from the interest on the loan. These fees are generally delineated in points (three to five), which represent additional percentage fees based on the loan amount. In general, hard money lenders charge much higher interest rates sometimes double the amount of a traditional mortgage, plus fees. ...

A self-directed IRA (Individual Retirement Account) is, at its most basic level, a savings account that allows for compounded, tax-free growth, over time. Self-directed IRAs are unique from other types of savings accounts, such as a 401K, as the owner can control a wide array of investment options, including real estate.

Together, the buyer and seller can often enjoy a faster transaction process, as well as avoid many costs and fees associated with the closing process. Furthermore, the owner has the option to sell the promissory note if they no longer want to manage their own owner financing.

When examining the large umbrella of different real estate financing options, one should also take into consideration loans that are offered by the government, traditional lenders, as well as methods of leveraging personal equity. Read on to find out some of the most popular loan options that are used creatively by investors, including real estate ...

203K loans are a special type of loan backed by the Federal Housing Administration, and is designed specifically for those who plan to rehabilitate older or damaged properties. The loan includes the price of the purchase of the property, plus the estimated costs to make renovations. 203K rehab loans are attractive to some because of the low down pa...

This policy is designed to help homeowners make mortgage payments during the time that they cannot live in the property during its rehabilitation phase. Investors should be aware, however, of some potential downsides to this particular loan. First, 203K borrowers are required to hire a licensed contractor and construction consultant, meaning that D...

When an investor has built up equity in the form of their personal residence, then they have the opportunity to take out a loan against that equity. A home equity loan, more formally known as a Home Equity Line of Credit (HELOC), allows homeowners to leverage their home equity as collateral in order to take out a loan. Common uses for a home equity...

The FHA loan is one of several home loan options offered by the federal government. The Federal Housing Administration (FHA) established the loan to help broaden access to homeownership for consumers with less-than-perfect credit profiles, as well as those who do not have the financial means to save up for a large down payment. When a new homebuyer...

It should be noted, however, that putting down less than 20 percent on a home loan will result in a required private mortgage insurance payment. In addition, the FHA loan only allows owner-occupied properties, but does allow for the purchase of a property with more than one unit. According to The Lenders Network, the current loan limit for a single...

Learn how to finance a real estate deal with different methods, such as cash, hard money, private money, self directed IRA, and seller financing. Compare the pros and cons of each option and find out how to access capital for your investment strategy.

- Paul Esajian

May 22, 2024 · The Consumer Financial Protection Bureau's Consumer Credit Panel reports a growing mortgage market, with a 31% increase in new mortgages from mid-2017 to mid-2018. Summary of Top Lenders. New...

Zillow Home Loans helps you get home on your budget with competitive rates, low down payment options and top-rated loan officers. Pre-qualify in minutes, get verified pre-approval and apply for a mortgage online or with a loan officer.

Apr 3, 2024 · Last updated on Apr 3, 2024. Commercial Property Loans in Columbus. In this article: Economy in Review. Multifamily Market. Office Market. Industrial Market. Retail Market. Self-Storage Market. Hospitality Market. Commercial Real Estate Loans by Purpose. Permanent Financing. Refinancing a Commercial Real Estate Property in Columbus.