Search results

Nov 20, 2018 · Comments (61.6K) Jonathan, I agree with you that Berkshire Hathaway can be great for income investors even though it does not pay a dividend. A $1,000 investment in Berkshire Hathaway in 1964 ...

Aug 27, 2015 · And the best news is that you can start investing with as little as $129 (the cost of one Berkshire Class B share). But income investors don’t typically own Berkshire Hathaway stock. In fact, a survey of my Income & Prosperity readers indicates that the stock isn’t widely held. The reason is simple: Berkshire Hathaway doesn’t pay a dividend.

News about Warren Buffett, Berkshire Hathaway, stocks

News about Warren Buffett, Vanguard Growth ETF, passive investing

Also in the news

People also ask

Is Berkshire Hathaway a good stock for small investors?

Is Berkshire Hathaway suitable for an IRA?

Should you buy Berkshire Hathaway?

How much is Berkshire Hathaway's stock portfolio worth?

1 day ago · Tracey compared Berkshire Hathaway (BRK.B Quick Quote BRK.B - Free Report) to Alphabet (GOOGL Quick Quote GOOGL - Free Report) because Alphabet is one of the cheapest of the Mag 7 stocks. 1.

- The Berkshire Hathaway Portfolio

- Warren Buffett's Management Style

- Berkshire Hathaway's Performance

- 2 Share Classes

- Does Berkshire Hathaway Fit in An Ira account?

- The Bottom Line

Berkshire Hathaway is a conglomerateof different companies. It also invests in publicly traded companies. Changes made by Buffett in the Berkshire portfolio often move the stock prices of the companies traded and get significant media coverage. Its top public equity holdings as of Feb. 8, 2023, include: 1. Apple (AAPL) with a $123.6 billion stake, ...

Buffett is a long-term, buy-and-hold investor focused on value. He has long been known to focus his investments on companies that he knows. As such, he usually avoids higher-risk, momentumnames. His preference is for well-established, slower-growth businesses. Buffett typically makes investments with plans to hold them for at least 10 years. One of...

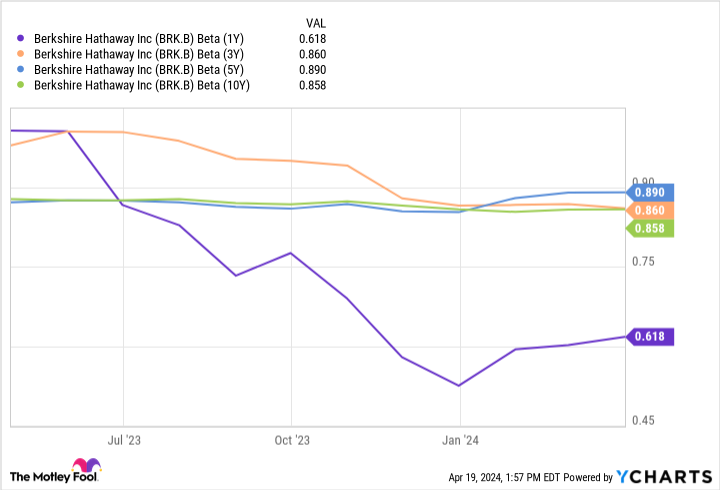

Buffett's investment style and choices make for a conservative portfolio overall, with less than average volatility. The principle of risk and returnsuggests stocks with lower risk levels also provide lower return potential. Buffett has delivered above-average returns over the long term. From 1965 to 2020, the average annualized return for Berkshir...

One of the most unusual features of Berkshire Hathaway stock is its stock price. It never splits. On Dec. 23, 2022, Berkshire Hathaway's Class A shares (BRK.A) closed at $463,400 per share.This puts even a single share purchase out of reach of many investors. Buffett is clear that he prefers to attract long-term investors as opposed to traders. In ...

For most investors, Class B shares are the only option when looking to add Berkshire Hathaway to an IRA. The maximum annual contribution to an IRA is $6,000 a year for 2022, rising to $6,500 for 2023. People who are 50 and older can make an additional catch-up contributionof $1,000. This means the Class A shares are not an option unless the investo...

The portfolio's composition of well-established mature businesses that can operate successfully in most market environments makes Berkshire Hathaway an investment that is appropriate for most IRA accounts. Buffett's style of investing for the long-term aligns well with the long-term nature of IRA accounts. Younger investorscan use the stock as a co...

- David Dierking

4 days ago · Berkshire Hathaway isn't the fastest-growing company in theworld. However, it still has a knack for delivering strong returns for its investors. Here's how Buffett's company compares to theS&P 500 ...

Oct 18, 2022 · Since Warren Buffett took over in the 1960s, Berkshire Hathaway ( BRK.A 0.62%) ( BRK.B 0.70%) has been one of the most impressive stocks in the history of the market. In this video, Certified ...

Mar 5, 2021 · Berkshire Hathaway Stock: Great Company, Good Price And A Potential Portfolio Anchor Mar. 05, 2021 2:25 PM ET Berkshire Hathaway Inc. (BRK.A) Stock , BRK.B Stock 247 Comments 87 Likes Jim Sloan