Search results

News about Dave Ramsey, retirement savings, Real assets

News about Dave Ramsey, Texas, Jean from Cincinnati

News about Dave Ramsey, Tori Spelling, ice business

With Dave’s 7 Baby Steps, you don't need a degree in finance to take control of your money. Anyone can do it! With each step, you’ll change how you handle money—little by little.

- 9 min

- Save $1,000 for Your Starter Emergency Fund. Only 32% of Americans say they can pay cash for a $400 emergency.That means 68% of them are borrowing, selling or going into debt when life happens.

- Pay Off All Debt (Except the House) Using the Debt Snowball. Debt’s good for one thing and one thing only: holding you back. But you don’t want to be held back.

- Save 3–6 Months of Expenses in a Fully Funded Emergency Fund. The debt is gone. Goodbye, debt. Talk to you never. Now, you’re going to build up that emergency savings fund so it’s strong enough to stand up to bigger problems, like job loss.

- Invest 15% of Your Household Income in Retirement. For some people, retirement can seem like tomorrow’s problem. But that kind of thinking will leave you working for the rest of your life.

Sep 20, 2021 · The 7 Baby Steps Explained - Dave Ramsey. 💵 Create Your Free Budget! Sign up for EveryDollar ⮕ https://ter.li/6h2c45 📱Download the Ramsey Network App ⮕ https://ter.li/ajeshj 🛒 Visit...

- 8 min

- 1.9M

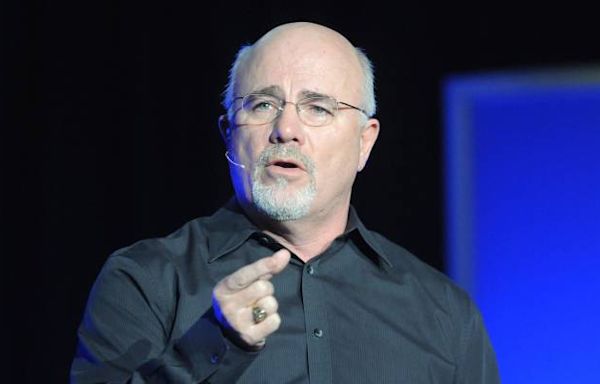

- The Ramsey Show Highlights

- Save $1,000 for Your Starter Emergency Fund. In this first step, your goal is to save $1,000 as fast as you can. Your emergency fund will cover those unexpected life events you can't plan for.

- Pay Off All Debt (Except the House) Using the Debt Snowball. Next, it’s time to pay off the cars, the credit cards, and your student loans.

- Save 3–6 Months of Expenses in a Fully Funded Emergency Fund. You’ve paid off your debt! Don’t slow down now. Take that money you were throwing at your debt and build a fully funded emergency fund that covers 3–6 months of your expenses.

- Invest 15% of Your Household Income in Retirement. It's time to get serious about retirement—no matter your age. Take 15% of your gross household income and start investing it into your retirement.

Jan 28, 2020 · The Dave Ramsey Baby Steps are Ramsey's sequential system to get out of debt and achieve financial freedom. There are seven steps that Ramsey recommends doing in this specific order.

Aug 27, 2013 · Dave Ramsey's Baby Steps — the plan to win with money. 💵 Create Your Free Budget! Sign up for EveryDollar ⮕ https://ter.li/6h2c45 📱Download the Ramsey Network App ⮕ https://ter.li ...

- 31 sec

- 187.7K

- The Ramsey Show Highlights