Search results

News about Nvidia, Amazon, artificial intelligence

News about Invesco QQQ Trust, technology stocks, reshoring

Also in the news

Find out which 7 technology stocks drove the market's returns in 2023 and 2024. See the list of companies, their stock prices, market caps, revenues and ETFs related to the magnificent seven.

May 21, 2024 · Magnificent 7 Stocks: What Are They and How They Dominate the Market. The "Magnificent 7" has emerged as a replacement for FAANG stocks. By Wayne Duggan. |. Edited by Jordan Schultz. |....

Dec 7, 2023 · The Magnificent Seven stocks are megacap companies focused and capitalizing on tech growth trends including AI, cloud computing, and cutting-edge hardware and software. Four of the five FAANG stocks retain their place amongst the Magnificent Seven, with newcomers Nvidia, Tesla, and Microsoft joining the group.

- Marcus Lu

- Overview

- The Magnificent 7 Stocks

- Historical Performance of the Magnificent 7 Stocks

- Factors Driving the Magnificent 7 Stocks

- Risks and Challenges of the Magnificent 7 Stocks

- What Is the Total Market Capitalization of the Magnificent 7 Stocks?

- What Is the Average Dividend Yield of the Magnificent 7 Stocks?

- How Would the Magnificent 7 Be Influenced by Inflation?

- The Bottom Line

- GeneratedCaptionsTabForHeroSec

“Magnificent Seven” was originally a reference to a 1960 Western film, “The Magnificent Seven,” which was directed by John Sturges and depicts a group of seven gunmen. In the world of finance, the term has been repurposed to reference a group of seven high-performing and influential

, borrowing from the meaning of a powerful group.

Bank of America analyst Michael Hartnett coined the phrase in 2023 when commenting on the seven companies commonly recognized for their market dominance, their technological impact, and their changes to consumer behavior and economic trends: Alphabet (

The Magnificent Seven stocks are a group of high-performing and influential companies in the U.S. stock market: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla.

The Magnificent Seven stocks are a group of the most influential companies in the U.S. stock market. This term has been popularized to describe a set of dominant companies, particularly in the tech sector.

The group comprises Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla and spans four sectors: technology services, electronic technology, retail trade, and consumer durables. They operate across these industries: internet software/services, telecommunications equipment, internet retail, packaged software, semiconductors, and motor vehicles.

“They are the highest quality names out there and, frankly, if we do go into a

next year...I actually think the Magnificent Seven will hold up better,” King Lip, chief strategist for BakerAvenue Wealth Management, told Reuters in November 2023.

The table below displays the performance of the Magnificent Seven stocks over the last three months, one year, and five years.

Historical Performance of the Magnificent Seven Stocks.

Over the past five years, NVIDIA has led the pack with an impressive

of 1094.64%, closely followed by Tesla, which has had a robust performance with an 807.56% gain. In the Magnificent Seven group, Apple, Microsoft, Alphabet, and Meta each delivered returns exceeding 100%. Amazon.com showed positive growth, but was the only member of this group to register a

The group of stocks known as the Magnificent Seven are at the forefront of technological changes across the economy, and they consistently develop new products and services that drive consumer demand and business growth. Here are other traits common among the Magnificent Seven stocks:

Each has adapted to changing market conditions, including shifts in consumer behavior and technological advances, by continuing to invest in research and development.

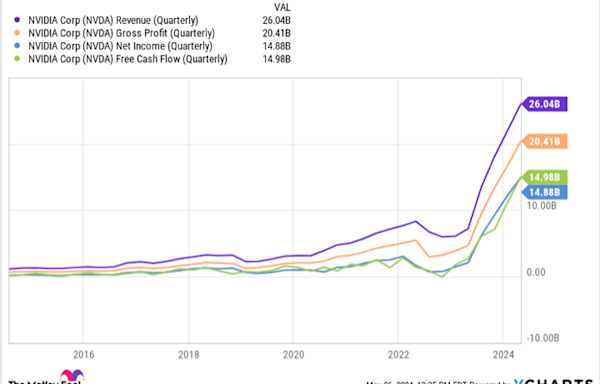

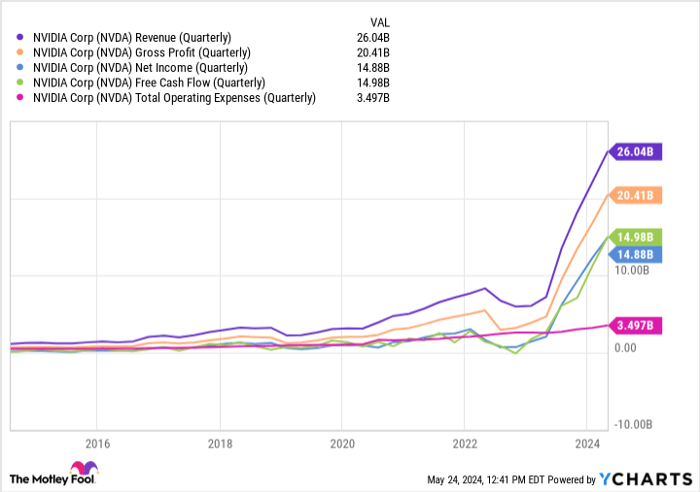

All have had strong financial health, robust

, making them attractive to investors for their growth.

Their operations and influence span the globe, allowing them to tap into diverse markets and benefit from international growth.

The Magnificent Seven have strong market positions in their sectors, often holding the dominant

Like any investment, putting your money into the Magnificent Seven stocks means taking on risks and challenges. Despite their strong market positions and record of driving technology forward, these companies face factors that could determine their performance. Here are some of them:

As global entities, these companies face risks associated with currency exchange rate

, affecting their earnings and stock prices.

As technology companies, the Magnificent Seven are prime targets for cyberattacks. A significant breach could lead to substantial financial losses and damage their reputations.

Global economic conditions, such as recessions or market downturns, can undermine consumer spending and business investment, transforming their revenues and growth prospects.

Geopolitical tensions and trade policies

of the Magnificent Seven stocks was $11.73 trillion as of Nov. 17, 2023.

yield for the companies that pay dividends was 0.45% as of Nov. 17, 2023.

AMZN: Amazon does not pay a dividend

GOOG: Alphabet does not pay a dividend

META: Meta does not pay a dividend

on the Magnificent Seven is complex. Some key ways that inflation would affect these companies include higher costs for materials, labor, and other operational expenses. Inflation can reduce consumers’ purchasing power, decreasing spending on nonessential goods and services.

ordinarily respond to high inflation by raising benchmark interest rates. Higher interest rates increase borrowing costs for companies, harming their investment and expansion plans. Nonetheless, the effect of inflation can vary within the Magnificent Seven group and depends on the company’s specific business model, cost structure, and market position.

The Magnificent Seven stocks represent a cohort of high-performing companies that have garnered significant attention in the investment world for their market dominance, technological advances, and growth potential. These stocks, which include Microsoft, Tesla, and NVIDIA, along with some FAANG members, are known for their influence across various sectors, such as software, hardware, electric vehicles, and artificial intelligence. They have been pivotal in driving technological trends and shaping consumer behavior, making them attractive to investors seeking growth and market leadership.

However, investors need to know the risks and challenges associated with these stocks. The dynamic nature of the technology sector, regulatory scrutiny, market saturation, and global economic factors like inflation and geopolitical tensions can affect their performance. Additionally, high market valuations bring lofty expectations, and any failure to meet these can lead to significant stock price corrections.

Learn what the Magnificent 7 Stocks are, how they have performed over time, and what factors drive their success. The Magnificent 7 Stocks are Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla.

- Cedric Thompson

May 7, 2024 · What are the Magnificent 7 stocks? By. Rocco Pendola. Paul Curcio. David Tony, CNN Underscored Money. Published 6:00 AM EDT, Tue May 7, 2024. Eoneren/iStock. First, there was FANG. Then came...

Jan 7, 2024 · The group is made up of mega-cap stocks Apple ( AAPL ), Alphabet ( GOOGL ), Microsoft ( MSFT ), Amazon.com ( AMZN ), Meta Platforms ( META ), Tesla ( TSLA) and Nvidia ( NVDA ). In 2023, the...

People also ask

What are the Magnificent 7 stocks?

Are the Magnificent 7 a good investment?

Is Apple a 'magnificent seven' stock?

Are the S&P 500 & Magnificent 7 stocks in positive territory?

Apr 20, 2024 · By Tanza Loudenback. The Magnificent Seven Stocks include Nvidia, Tesla and other high-performing tech stocks. In 2023, these stocks each returned at least 48% and some more than 100%.