Search results

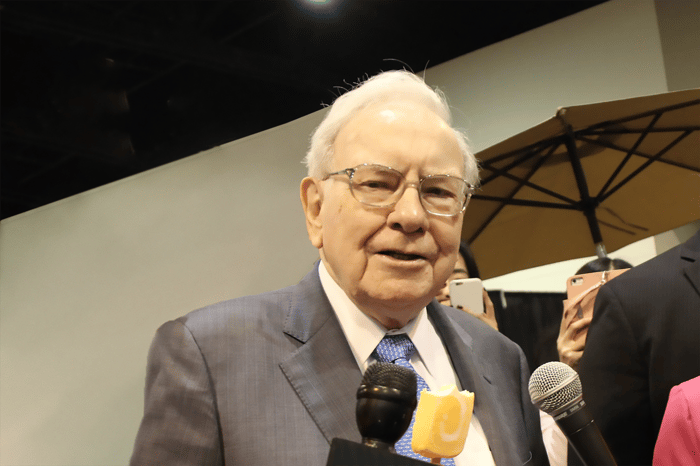

News about Warren Buffett, Berkshire Hathaway, dividend stocks

News about e.l.f. Beauty, Bank of America, Warren Buffett

- Coca-Cola. Market value: $253.8 billion. Dividend yield: 3.1% Percentage of Berkshire Hathaway portfolio: 7.2% Berkshire Hathaway ownership stake: 9.2% Coca-Cola (KO, $58.71) is one of Berkshire's oldest holdings and one of the best Warren Buffett dividend stocks.

- Bank of America. Market value: $253.8 billion. Dividend yield: 3.1% Percentage of Berkshire Hathaway portfolio: 9.0% Berkshire Hathaway ownership stake: 12.8%

- HP. Market value: $30.0 billion. Dividend yield: 3.7% Percentage of Berkshire Hathaway portfolio: 0.8% Berkshire Hathaway ownership stake: 9.7% Berkshire started buying HP (HPQ, $30.24) in the first quarter of 2022.

- Chevron. Market value: $286.8 billion. Dividend yield: 4.0% Percentage of Berkshire Hathaway portfolio: 5.9% Berkshire Hathaway ownership stake: 5.7% Energy stocks had an outstanding year in 2022.

Apr 5, 2024 · With over a decade of consistent dividend hikes and a solid business, Mastercard Inc (NYSE:MA) is one of the best dividend stocks in Warren Buffett’s portfolio. In December 2023, the...

- Chevron: $904,131,705 in Passive Income Over The Next 12 Months

- Occidental Petroleum: $874,444,444

- Bank of America: $867,595,685

- Apple: $838,439,808

- Coca-Cola: $704,000,000

- Kraft Heinz: $521,015,709

- American Express: $315,350,256

- U.S. Bancorp: $265,045,247

- Citigroup: $112,699,386

- Bank of New York Mellon: $101,111,735

The passive income kingpin in Buffett's portfolio is integrated oil and gas stock Chevron (CVX-0.80%). Berkshire acquired nearly 121 million shares of the energy giant during the first quarter. Aside from its hearty 3.4% dividend yield, Buffett piling into Chevron likely signals his belief that crude oil and natural gas prices will remain elevatedf...

Interestingly, Buffett's two best dividend stocks, based on payout, are oil stocks. Occidental Petroleum (OXY-1.63%)is expected to hand over more than $874 million to Berkshire Hathaway over the next year. The bulk of this passive income stream -- $800 million annually -- derives from $10 billion in preferred stockthat Berkshire owns. This $10 bill...

Warren Buffett loves bank stocks, so it's no surprise to see Bank of America (BAC-0.89%)as one of his best dividend stocks. The more than 1 billion shares of BofA held should translate into almost $868 million in annual dividend income. Buffett tends to like banks because they're cyclical. Even though recessions are inevitable, they don't last very...

Tech behemoth Apple (AAPL0.69%)is Berkshire Hathaway's largest holding and accounts for more than 38% of the company's invested assets. Based on an aggregate of roughly 911 million shares held, Buffett's company can expect $838.4 million in dividend income over the next year. As I've previously pointed out, Apple checks all the right boxes for Buff...

Beverage stock Coca-Cola (KO-1.92%) is the Oracle of Omaha's longest-tenured holding. A fixture in Berkshire Hathaway's portfolio since 1988, Coke has increased its base annual payout for 60 consecutive years. Coca-Cola's secret sauce continues to be its geographic diversity and marketing. With the exception of North Korea, Cuba, and Russia (the la...

Even though it's been one of Warren Buffett's worst investments, packaged foods company Kraft Heinz (KHC0.17%)is one of Berkshire's passive income superstars with a 4.1% yield. Whereas most companies have been adversely impacted by the COVID-19 pandemic, Kraft Heinz received a boost. With more people choosing to eat at home, quick-prep meals and pa...

If not for Coca-Cola, credit services company American Express (AXP0.04%)would be Buffett's longest-held stock. A continuous holding since 1993, AmEx is on pace to generate more than $315 million in passive income for the Oracle of Omaha over the next 12 months. Like most financial stocks, American Express is cyclical, which therefore allows it to ...

Have I mentioned that Buffett loves bank stocks? Regional bank U.S. Bancorp (USB-1.13%), the parent of U.S. Bank, is another favorite that's set to bring in around $265 million in annual dividend income. One the best aspects of U.S. Bancorp is its relatively conservative management team. Instead of chasing the riskier derivative investments that go...

Yet another money-center bank that'll be piling on the passive income for Warren Buffett's company over the next year is Citigroup (C-0.54%). Berkshire purchased more than 55 million shares of Citi in the first quarter, which should translate into north of $112 million in annual dividend income. Citigroup is arguably the least-liked big U.S. bank. ...

Finally, America's largest custodial bank, Bank of New York Mellon (BK0.38%), rounds out Buffett's 10 best dividend stocks. Perhaps the biggest catalyst for Bank of NY Mellonis the Federal Reserve's shift to hawkish monetary policy. Higher interest rates should allow the company to recognize a significant boost in net interest revenue. For context,...

- Moody’s Corporation (NYSE:MCO) Berkshire Hathaway's Stake Value: $5,997,470,000. Dividend Yield as of November 18: 0.95% Moody’s Corporation (NYSE:MCO) is a New York-based credit and financial services company that provides services related to risk analysis and credit ratings.

- U.S. Bancorp (NYSE:USB) Berkshire Hathaway's Stake Value: $3,136,420,000. Dividend Yield as of November 18: 4.45% U.S. Bancorp (NYSE:USB) is an American bank holding company.

- The Bank of New York Mellon Corporation (NYSE:BK) Berkshire Hathaway's Stake Value: $2,396,364,000. Dividend Yield as of November 18: 3.33% The Bank of New York Mellon Corporation (NYSE:BK) is a New York-based investment banking services holding company that conducts businesses in all markets of the world.

- Citigroup Inc. (NYSE:C) Berkshire Hathaway's Stake Value: $2,298,341,000. Dividend Yield as of November 18: 4.71% (NYSE:C) is an American multinational investment banking company that offers related services to its consumers.

- Occidental Petroleum Corp (NYSE:OXY) Warren Buffett's Stake: $14,552,270,657. Occidental Petroleum Corp (NYSE:OXY) earlier in February said it will increase its dividend from last year's comparable payment on the 15th of April to $0.22.

- Kraft Heinz Co (NASDAQ:KHC) Warren Buffett's Stake: $12,041,975,570. With a dividend yield of about 4.4%, Kraft Heinz Co (NASDAQ:KHC) ranks seventh in our list of the best dividend stocks to buy according to Warren Buffett.

- Moody's Corp (NYSE:MCO) Warren Buffett's Stake: $9,635,028,496. Moody's Corp (NYSE:MCO) earlier this month increased its dividend by 10.4%. The new dividend is payable by March 15.

- Citigroup Inc (NYSE:C) Warren Buffett's Stake: $2,841,792,358. With a dividend yield of about 3.8% as of February 27, Citigroup Inc (NYSE:C) is one of the top dividend stocks in Warren Buffett's portfolio since Berkshire had a $2.84 billion stake in Citigroup Inc (NYSE:C).

Jul 1, 2024 · The Best Warren Buffett Stocks. Apple Inc. (AAPL) 5.1% $150.9 billion. 40.4% Editor's Take. Bank of America Corp. (BAC) 13.2% $39.9 billion. 10.7% Editor's Take. American Express Co. (AXP)

People also ask

Does Warren Buffett like dividends?

Is Warren Buffett a good stock to buy?

What are Buffett's best dividend stocks?

What are Buffett's worst high-yield dividend stocks?

Apr 1, 2024 · Key Points. Berkshire Hathaway's portfolio includes 12 high-yield dividend stocks. Some of Buffett's stocks offer more attractive yields, valuations, and growth prospects than others. The...