Search results

The IRS provides online tools and applications to help you file your taxes, check your refund status, get your tax records and more. Find out the latest news and updates on tax credits, deductions, penalties and operations.

- Your Online Account

Make a payment from your bank account or by debit/credit...

- Forms & Instructions

Form 1040. US Individual Income Tax Return. Annual income...

- Filing

Find guidance for filing personal income taxes and tax...

- Telephone Assistance

Taxpayer Advocate Service. If you’re having tax problems...

- Payments

View the amount you owe, your payment plan details, payment...

- Tax Professionals

Information for tax professionals. Access online tools for...

- Individuals

Steps to file. Use these steps and resources to make filing...

- Where's My Amended Return

You can check the status of an amended return around 3 weeks...

- Credits & Deductions

All credits and deductions for individuals: Dependent care,...

- 2021 Child Tax Credit

Under the American Rescue Plan of 2021, advance payments of...

- Document Upload Tool Upload documents in response to an IRS notice or letter. Submit requested files

- Sign in to your account

- IRS Free File Prepare and file your federal income taxes online for free. Try IRS Free File

- Where's My Refund Get your refund status

- Bank Account (Direct Pay)

- Get Your Tax Record

- Get an Identity Protection PIN (IP PIN)

- Tax Withholding Estimator

- Find a Local Office

- Free tax preparation Get free one-on-one tax preparation help nationwide if you qualify Find a site near you

- Employee Retention Credit You can withdraw incorrect ERC claims if you haven’t received the money

- Inflation Reduction Act Strategic Operating Plan See how the IRS will deliver transformational change Read the Plan

- Clean energy credits and deductions Updates on credits and deductions under the Inflation Reduction Act

- Tax Updates and News Special updates and news for 2024 Read the latest developments

- Penalty relief for many taxpayers Prior year collection notices to resume in 2024

- IRS operations status Check our current processing times for returns, refunds and other services.

- Your Online Account

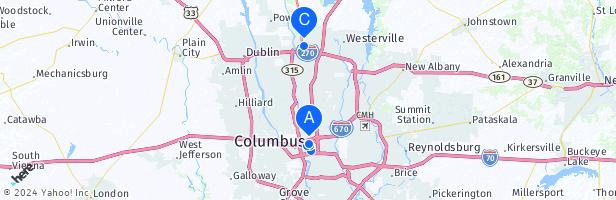

Discover more placesNear Columbus, OH

Refine results for Finance & Taxation

- Access Tax Records

- Make and View Payments

- View Or Create Payment Plans

- Manage Communication Preferences

- View Tax Pro Authorizations

- Accessibility

- Other Ways to Find Your Account Information

- GeneratedCaptionsTabForHeroSec

View key data from your most recently filed tax return, including your adjusted gross income, and access transcriptsView digital copies of certain notices from the IRSView information about your Economic Impact PaymentsView information about your advance Child Tax Credit paymentsMake a payment from your bank account or by debit/credit cardView 5 years of payment history, including your estimated tax paymentsSchedule and cancel future paymentsView pending and scheduled paymentsLearn about payment plan options and apply for a new payment planView and revise details of your payment plan if you have oneGo paperless for certain noticesGet email notifications for new account information or activityView any authorization requests from tax professionalsApprove and electronically sign Power of Attorney and Tax Information Authorization from your tax professionalThere are compatibility issues with some assistive technologies. Refer to the accessibility guidefor help if you use a screen reader, screen magnifier or voice command software.

You can request an Account Transcript by mail. Note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.If you're a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.Access your individual account information including balance, payments, tax records and more. Sign in to your Online Account or request an Account Transcript by mail if you're a business or filed a form other than 1040.

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law.

- $14.3 billion (2022)

- 93,654 (2022) (79,070 FTE) (2022)

- July 1, 1862; 161 years ago (though the name originates from 1918)

- Department of the Treasury

People also ask

What does the Internal Revenue Service do?

What is the Internal Revenue Manual?

What happened to the Internal Revenue Service?

How much is the Internal Revenue Service budget?

Mar 1, 2024 · Learn how to pay your taxes, estimated taxes, or other types of payments to the IRS online or by other methods. Find out the benefits and options of payment plans, installment agreements, Offer in Compromise, and more.

The IRS is the federal agency that collects taxes and enforces tax laws in the U.S. Find out how to contact the IRS, get tax help, and locate a taxpayer assistance center near you.

IRS Free File: Guided Tax Software. Do your taxes online for free with an IRS Free File trusted partner. If your adjusted gross income (AGI) was $79,000 or less, review each trusted partner’s offer to make sure you qualify. Some offers include a free state tax return.

Find answers to your tax law questions, access your online account, file your return, make payments, and more. Browse the tools available for individual taxpayers, businesses, and tax professionals.