Search results

Records, Taxes and Treasury Property Tax Bills. How to Pay Your Property Tax Bill. Property tax bills are available to view, print and pay onlinestarting November 1, 2023. For taxpayers whose bills are paid by escrow arrangement, a courtesy tax bill copy will be mailed in mid-November.

Property Tax Search - TaxSys - Broward County Records, Taxes & Treasury Div. Site action search. Search and Pay Property TaxSearch and Pay Business TaxPay Tourist TaxEdit Business Tax accountApply for Business Tax accountRun a Business Tax reportRun a Real Estate reportRun a Tangible Property report. Cart; 0 items.

Property Taxes Resources

The Records, Taxes and Treasury Division provides County property owners official documents at little or no cost. Save money here. County residents are also being charged premium fees by private companies for Auto Tag and Registration documents. Our Division can save you money with getting these official documents here .

All property tax billing and collection is handled by the Broward County Tax Collector's Office. Should you have any questions regarding your taxes, please visit the Tax Collector's website directly for additional information. The Tax Collector's office can also be reached at (954) 357-4829 or revenue@broward.org.

Each year, the Broward County Tax Collector mails more than 500,000 property tax bills. Below, are answers to some of the most frequently asked questions about tax payments, payment plans, and delinquency interest and fees.

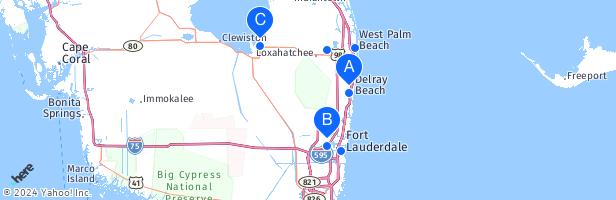

Service Locations. Can’t find what you need here? Call Broward County Call 954-357-4TAX (4829) .