Search results

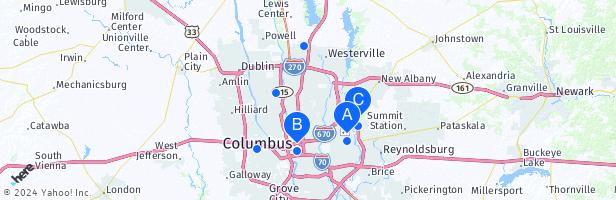

Discover more placesNear Columbus, OH

Related businesses

Aug 3, 2021 · Credit counseling is a process in which you work with a credit counselor to develop a plan for managing your finances. The end goal is to improve your financial situation, supported by...

Mar 1, 2019 · Consumer credit counseling services exist to help consumers who are struggling to get out of credit card debt. When a person can’t get out of debt on their own but wants to avoid bankruptcy, counseling is there to provide solutions. Consolidated Credit is one of the nation’s largest nonprofit credit counseling services.

Mar 30, 2022 · The five main services available from credit counseling agencies are: General budgeting: A free initial session, typically an hour long, explores your financial life, including income, expenses...

Mar 30, 2024 · The best credit counseling agencies, such as Apprisen and Cambridge Credit Counseling, offer debt management plans and education programs at low costs.

Our certified credit counselors provide expert guidance and support, creating tailored action plans for debt management, budgeting, and credit score improvement. With a commitment to personalized attention and exceptional service, CCCF equips clients with the knowledge and skills needed to make informed financial decisions.

Find the Best Nonprofit Credit Counselor for You. Fill out the form below to schedule a financial review with a nonprofit, NFCC-certified credit counselor from our trusted network of Member Agencies. We will connect you with the representative best suited to meet your needs.

Struggling with debt or poor credit? Consumer credit counseling can help. Our certified consumer credit counselors provide personalized advice to manage debt and improve credit. Start your journey to a healthier financial future today.