Search results

Aug 22, 2024 · A leverage ratio is a type of financial measurement used in finance, business, and economics to evaluate the level of debt relative to another financial metric. It can be used to measure how...

Aug 21, 2024 · A leverage ratio is a financial measurement of debt. It puts an entity's debt into better context by showing it as a ratio relative to another financial metric like equity or earnings. A...

- Matthew Dilallo

Aug 21, 2024 · Leverage ratios are assessment tools that help investors determine a company's financial position, given the debt utilized for purchasing assets and resources. These ratios include debt-to-equity ratio, debt-to-assets ratio, debt-to-capital ratio, and debt-to-EBITDA ratio.

Aug 21, 2024 · The formula for leverage ratios is used to measure the debt level relative to the size of the balance sheet. The calculation of leverage ratios is primarily by comparing the total debt obligation relative to either the total assets or the equity contribution of the business.

Aug 21, 2024 · The leverage effect is a strategic approach where businesses utilize borrowed funds, commonly in debt, to finance asset acquisitions. The underlying effect is that these assets' returns, or capital gains surpass the associated borrowing costs, magnifying the overall profitability.

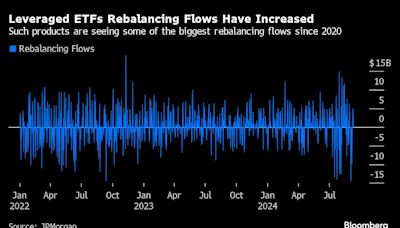

Aug 23, 2024 · What is a leveraged ETF? A leveraged ETF (exchange traded fund), which holds both debt and shareholder equity, uses the debt to amplify the daily return to shareholders.

Aug 18, 2024 · A leverage ratio is a financial measurement that examines how much capital a borrower has and compares this amount to the borrower's total asset value or liability total. Each ratio focuses on one or more of the following factors: debt, equity, assets and interest expenses.