Search results

Pay your taxes. Get your refund status. Find IRS forms and answers to tax questions. We help you understand and meet your federal tax responsibilities.

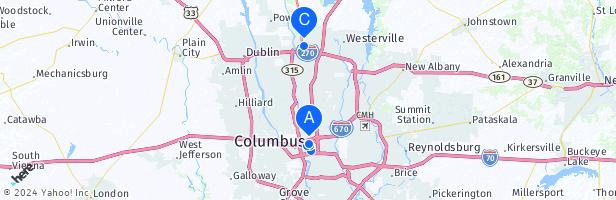

Discover more placesNear Columbus, OH

Refine results for Finance & Taxation

Jun 7, 2024 · Access your individual account information including balance, payments, tax records and more. Sign in to your online account. If you're a new user, have your photo identification ready. More information about identity verification is available on the sign-in page.

Jun 14, 2024 · Explore options for getting your federal tax refund, how to check your refund status, how to adjust next year’s refund and how to resolve refund problems.

Feb 8, 2024 · Find guidance for filing personal income taxes and tax information for businesses, charities and nonprofits, international filers and others.

The Internal Revenue Service (IRS) administers and enforces U.S. federal tax laws.

Get Refund Status. Please enter your Social Security Number, Tax Year, your Filing Status, and the Refund Amount as shown on your tax return. All fields marked with an asterisk (*) are required. Enter the SSN or ITIN shown on your tax return.

Get Faster Service Online. You can get help with most tax issues online or by phone. On IRS.gov you can: Set up a payment plan. Get a transcript of your tax return. Make a payment. Check on your refund. Find answers to many of your tax questions. File your tax return online.

Your online account. Access your individual account information to view your balance, make and view payments, view or create payment plans, manage communication preferences, access some tax records, and view and approve authorization requests. Get Transcript.

Mar 1, 2024 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make payments from your bank account for your balance, payment plan, estimated tax, or other types of payments. Go to Your Account.

Jan 4, 2024 · Visit the IRS contact page to get help using online tools and resources. Or: For individual tax returns, call 1-800-829-1040, 7 AM - 7 PM Monday through Friday local time. The wait time to speak with a representative may be long. This option works best for less complex questions.