Search results

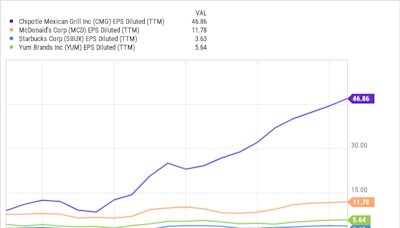

- These metrics have especially risen the past few years as consumers have been willing to accept larger price increases and has subsequently led the market to assign Chipotle’s stock a high earnings multiple as it trades at a P/E ratio of about 55 using trailing twelve month GAAP figures.

seekingalpha.com › article › 4618186-chipotle-fairly-valued-but-downside-risk-loomsChipotle: Fairly Valued, But Downside Risk Looms - Seeking Alpha

People also ask

Why did Chipotle raise its operating margins?

Does Chipotle's stock obliterate the market?

Why are investors buying Chipotle stock?

Will Chipotle stock reach $3500?

6 days ago · CMG stock has seen extremely strong gains of 130% from levels of $1385 in early January 2021 to around $3173 now, vs. an increase of about 40% for the S&P 500 over this roughly 3-year period ...

Dec 19, 2021 · The Tex-Mex chain has seen its sales surge. The stock, up 200% since March of 2020, has doubled the S&P 500's gain and now carries a price-to-earnings ratio (P/E ratio) of 68. Investor optimism...

May 16, 2023 · The restaurant's resilient sales growth during a challenging macroeconomic environment is a testament to the burrito maker's appeal to both existing and new customers. Here's a closer look...

- Daniel Sparks

Feb 11, 2024 · In the past five years, this magnificent restaurant stock has skyrocketed 406%, crushing the S&P 500 by a wide margin. Here's why investors are buying Chipotle hand over fist right now.

6 days ago · Chipotle (NYSE:CMG) has sustained an incredible rally year-to-date, with its stock advancing by roughly 38% to $3,162 during this period.

Despite massive long-term growth and high earnings multiples, the growth in Chipotle stock is unlikely to end anytime soon. Amid a rapid U.S. expansion, it has only completed about half its...