Search results

Apr 16, 2024 · In the money (ITM) means that an option has value or its strike price is favorable compared to the prevailing market price of the underlying asset.

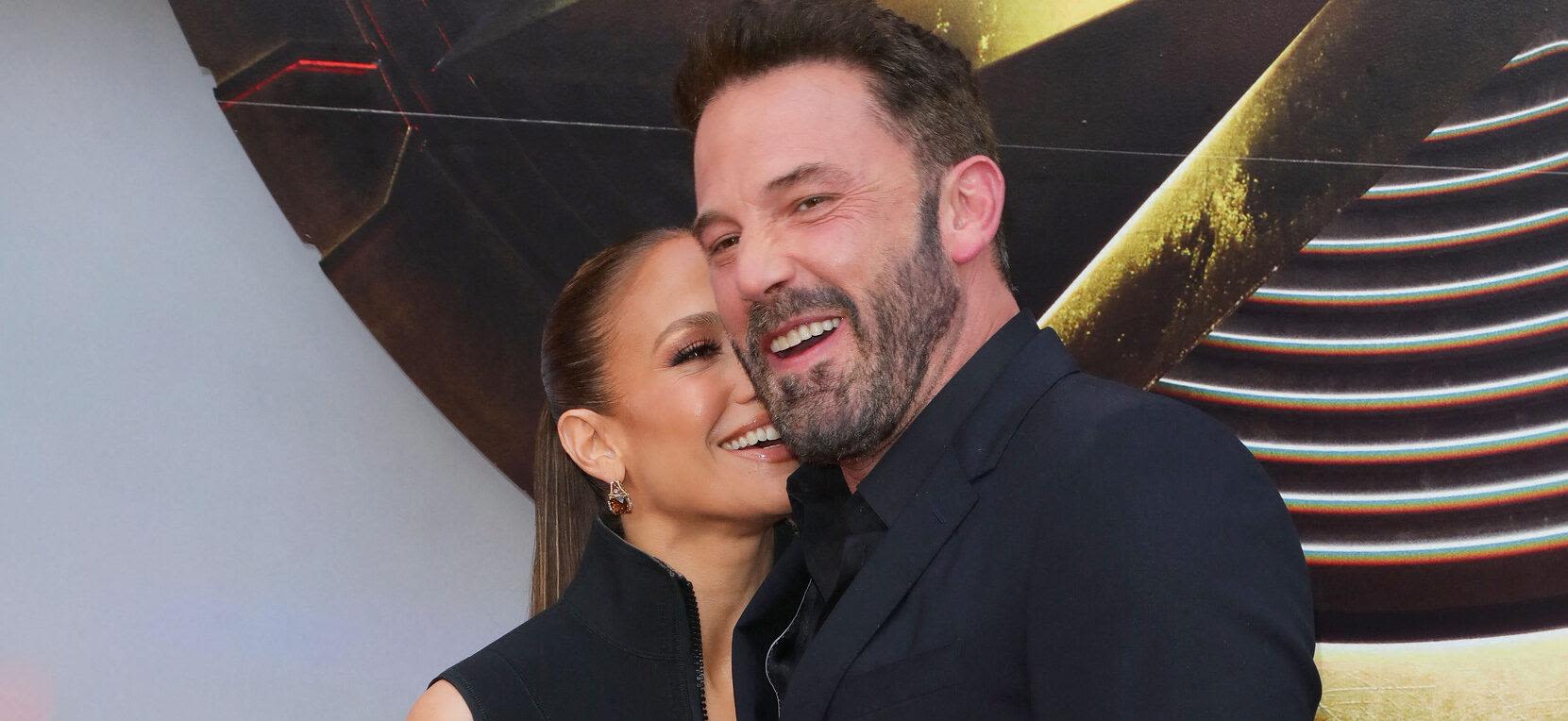

News about Jennifer Lopez, Ben Affleck, alcohol line

News about WWE SummerSlam 2024, live updates, matches

Also in the news

May 18, 2024 · Traders define options as "in the money" (ITM) or "out of the money" (OTM) by the strike price's position relative to the market value of the underlying stock, commonly called its moneyness.

May 20, 2021 · When trading options, it’s important to understand the difference between in the money vs. out of the money. In simple terms, this is a way to measure an option’s intrinsic value, relative to the underlying asset’s current price.

Sep 26, 2022 · “In the money” and “out of the money” are phrases that describe when an option has positive or negative intrinsic value, respectively. In other words, they’re used when the strike price of an option and the market price for a security are different.

Apr 11, 2024 · Guide to In the Money and its Meaning. We explain the concept along with vs OTM, vs ATM, examples, advantages & disadvantages.

May 23, 2024 · A call option is in the money (ITM) when the underlying security's current market price is higher than the call option's strike price. Being in the money gives a call option intrinsic value.

In the Money ®: Weekly trade ideas and options strategies Whether you're new to options or a seasoned investor, our team of pros can help you step up your game. Every week, we'll break down complex strategies and share actionable ideas for traders of every level.