Search results

Jan 9, 2024 · IRS Schedule C is a tax form for reporting profit or loss from a business. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040. Schedule C is...

Mar 28, 2024 · IRS Schedule C, Profit or Loss from Business, is a tax form you file with your Form 1040 to report income and expenses for your business. The resulting profit or loss is typically considered self-employment income. Usually, if you fill out Schedule C you'll also have to fill out Schedule SE, "Self-Employment Tax."

Nov 16, 2023 · Schedule C is a tax form used to report business-related income and expenses. This schedule is completed by self-employed individuals, sole proprietors, or single-member LLCs. A business...

Feb 26, 2024 · Schedule C is a form used to report self-employment income on a personal return. “Self-employment income” is how we describe all earned income derived from non-W-2 sources. This could be income from your small business, freelance work, or just extra cash earned through a side hustle.

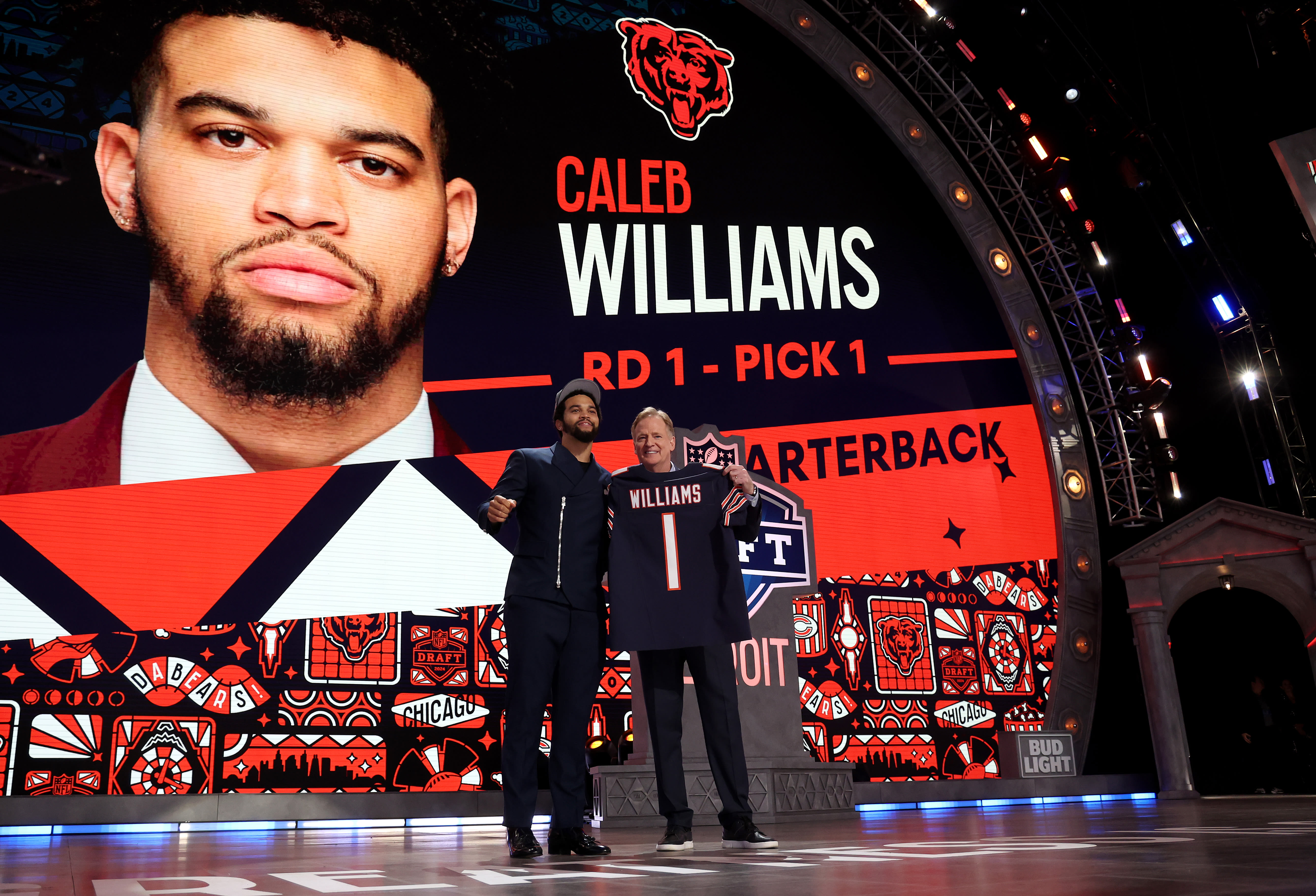

News about NFL, Bears, schedule release

News about Detroit Lions, defensive lineman, Kyle Peko

Also in the news

May 18, 2022 · Schedule C, whose full name is Form 1040 Schedule C - Profit or Loss from Business, is where most small business owners report their business net profit or loss. Net profit or loss as...

Jan 23, 2023 · If you are a sole proprietor of a business, you must use Schedule C to report your profit or loss on your tax return. You should also use Schedule C if you are the sole member of an LLC or in a qualified joint venture. To complete Schedule C for your small business taxes, you'll need your business income, costs of goods sold, and more.

Oct 23, 2023 · Schedule C is a tax form for self-employed people to report business income. It's also used to report tax-deductible business expenses, such as home office or equipment costs. If a business's...